Cisco Calling Plan bill

Feedback?

Feedback?Understand your bill

Your Cisco monthly bill includes information of call activity, charges, and applicable fees and taxes. The bill is divided into the following sections, each described further down in detail:

-

Header

-

Recurring Charges

-

Usage and Overage Charges

-

Annexure

To view the screenshots included for your reference and a complete sample of the invoice, click Invoice.

As shown in this article, the Partner of record receives detailed invoices (in PDF or CSV formats) monthly. You can view them in Cisco Commerce Workspace (CCW) under the subscription ID. If the invoice you receive from your Partner looks different than the following screenshot, contact your Partner to get the additional details from the Cisco invoice.

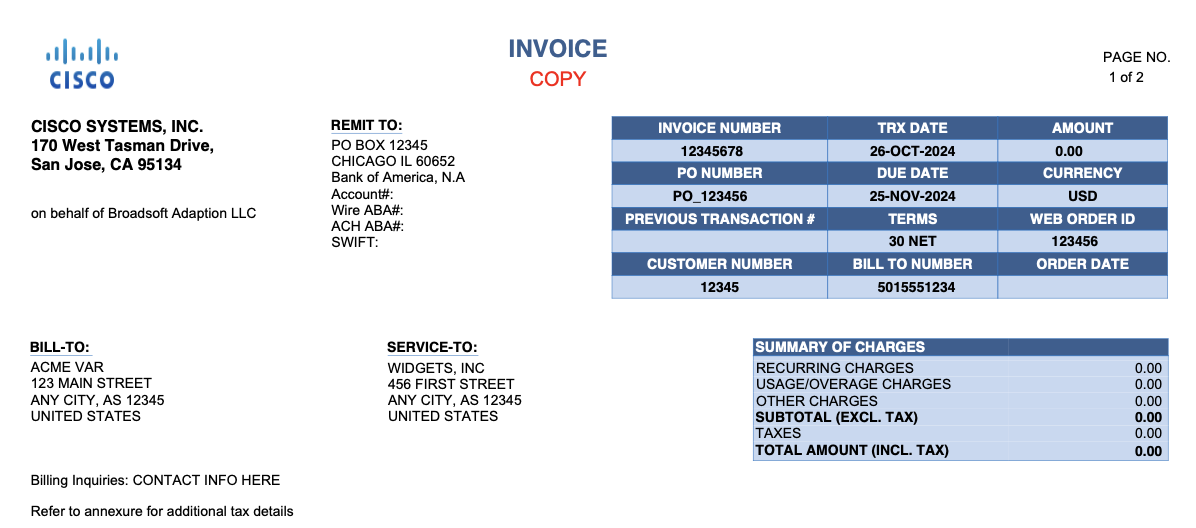

Header

The header of your Cisco Calling Plan bill contains your account information and details of that month’s specific bill. It’s important to note that your Cisco Calling Plan monthly bill is based on your subscription with Cisco, with each subscription receiving a single invoice. One subscription might cover multiple locations, depending on how you set up your services in the Control Hub. Individuals with multiple subscriptions receive multiple bills.

-

TRX Date—The date on which the data being billed was extracted. As you can see in the following sections, some services are billed in advance, while some services, such as usage and overages, are billed in arrears based on this date.

-

Bill To Number—Often seen as BTN, this is the number that is used for porting purposes when necessary.

-

Summary of Charges—Summarizes everything that is contained within the bill. You can see these charges further down your Cisco Calling Plan bill.

-

Billing Inquiries—For questions on charges contained within this bill, use the contact information provided here.

-

Recurring Charges—Recurring charges are committed charges which occur on a repetitive basis for each month of the subscription. At the time of subscription, the partner chooses the billing frequency based on which the recurring services are charged in the invoice. This section shows only the committed number of Outbound Calling Plans.

Recurring charges listed in this section, along with the associated taxes to each of these charges, are billed a month in advance.

-

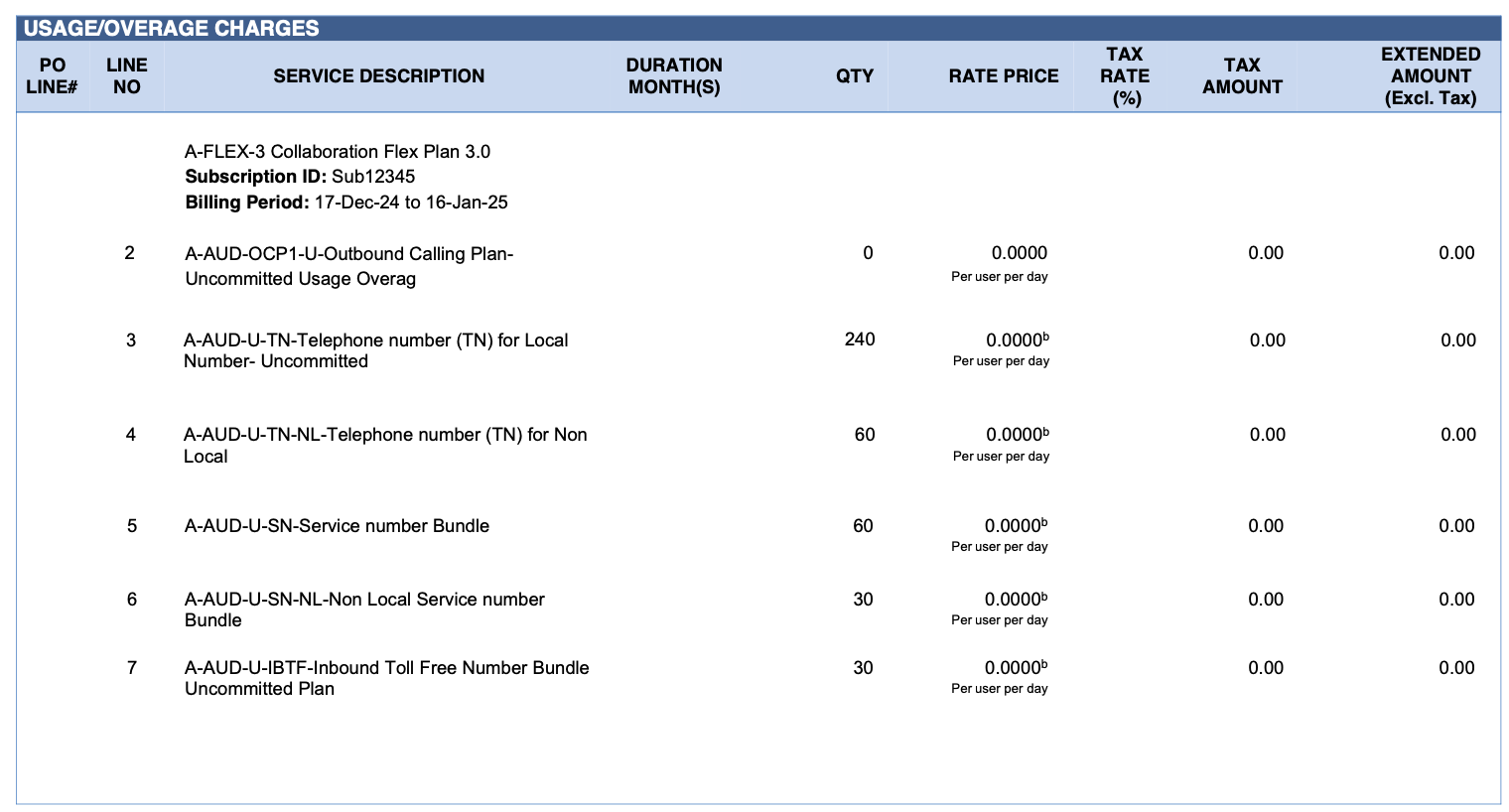

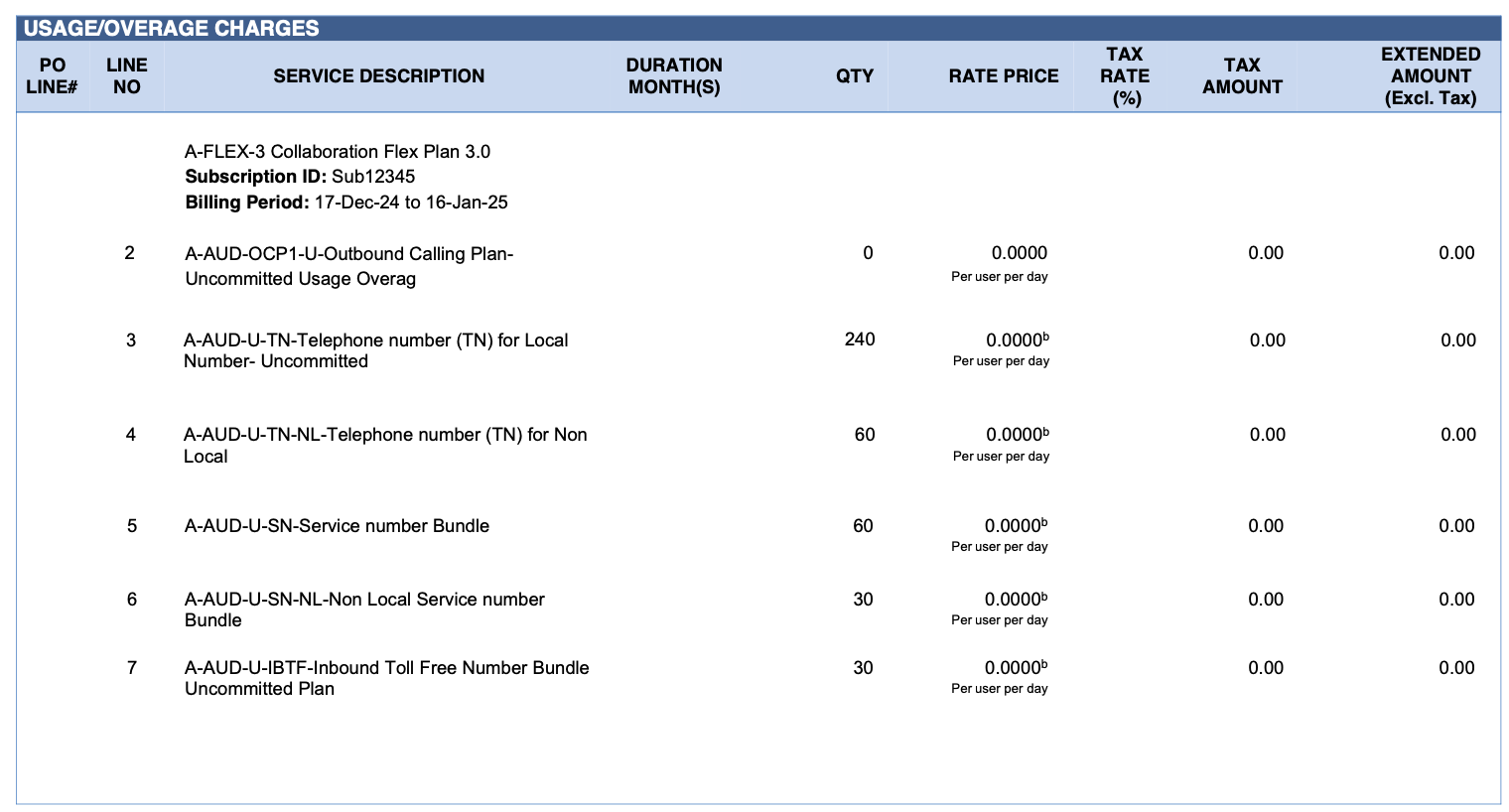

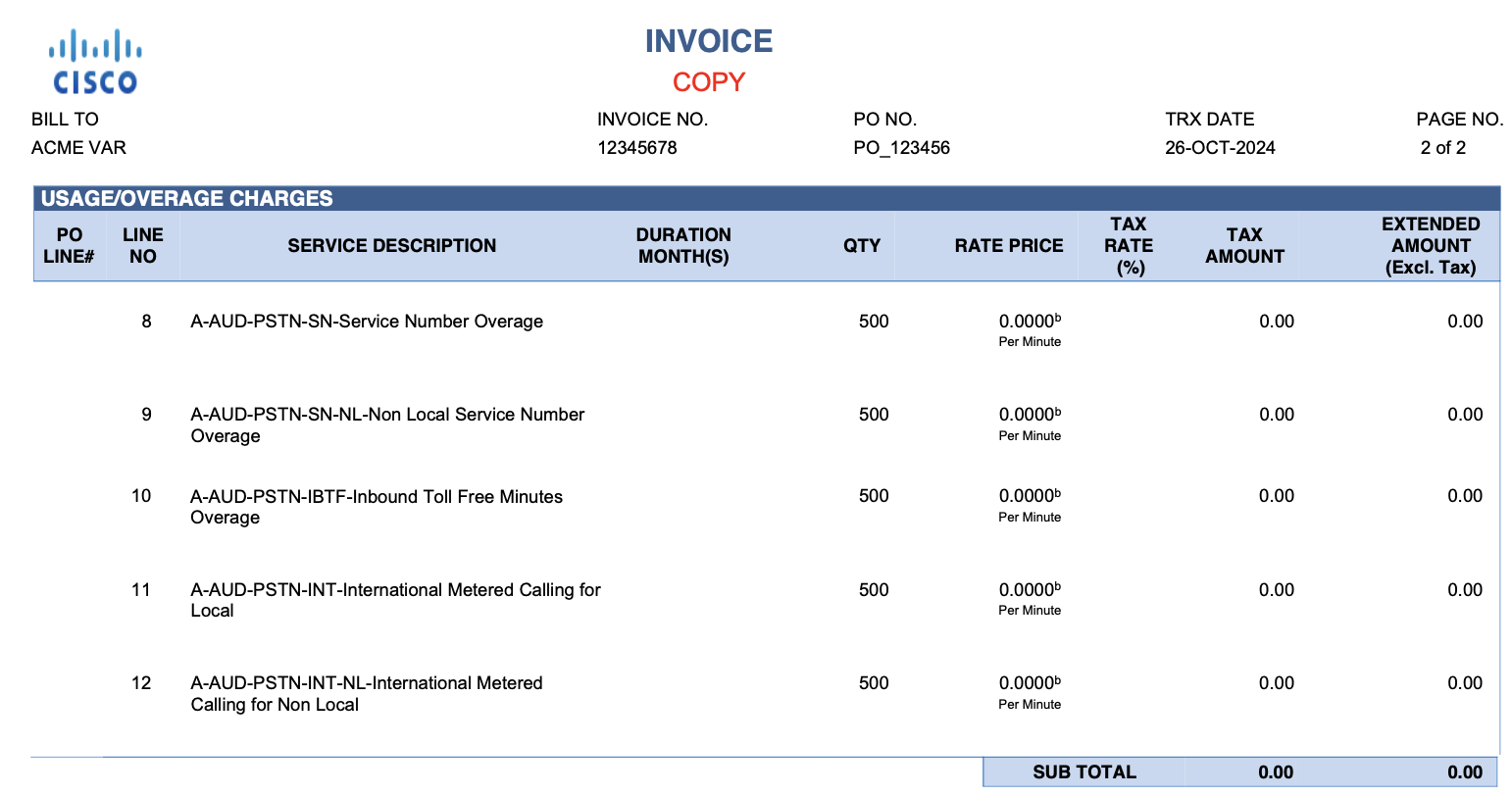

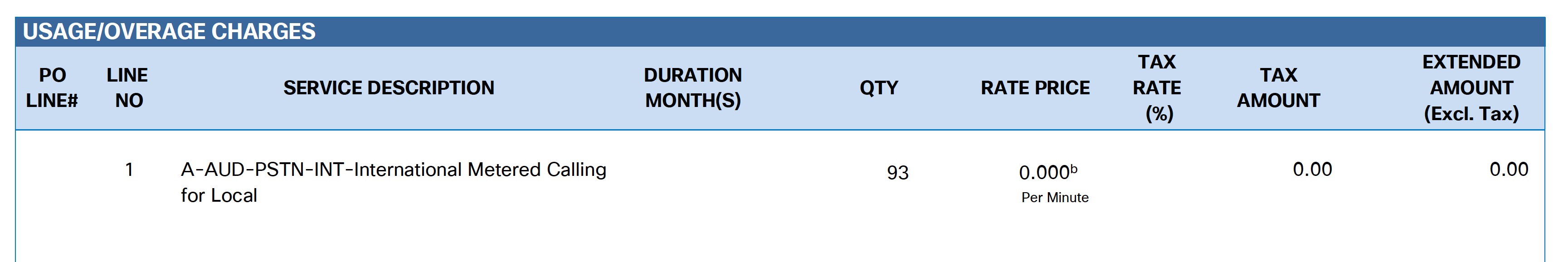

Usage and Overage Charges—Usage and Overage Charges in this section are based on uncommitted elements of your Cisco Calling Plan that are incurred during the billing period. This includes, but isn’t limited to telephone numbers (standard, service, or inbound toll-free), outbound calling plan overages, minutes of use, international calls, activation fees and more.

All usage and overage fees are billed after charges occurred, generally on the next invoice (30 days in the arrears). Billing frequency of the subscription and committed charges doesn’t influence the billing of usage charges. They are billed every month.

Usage and Overage Charges, and associated taxes to each of these charges, are billed for the month leading up to receiving your invoice, after the charges have been incurred.

-

Outbound Calling Plan—Each bill includes at least ONE committed Outbound Calling Plan in the recurring charges section. But Cisco provides the flexibility for customers to assign more Outbound Calling Plans to users than what they commit to. These are considered as Uncommitted and are billed on a per-day rate, regardless of active Outbound Calling Plan duration during a day.

-

Telephone Number (TN)—Telephone numbers incur billing for each day of their provisioning, regardless of how long the TN was provisioned for on a particular day. While the QTY section might seem like a high number, the QTY is determined by adding the total number of days each TN was provisioned during the billing cycle. The RATE PRICE is a daily rate price per TN, which is then multiplied by the total QTY.

-

Example: A customer has three numbers that are billed during a billing cycle: Two TNs were provisioned for the full 30 days, while one TN was provisioned for only 15 days.

QTY: 30 + 30 + 15 = 75

RATE PRICE: $0.035 (for example purposes only)

EXTENDED AMOUNT: $2.63 for the month

-

-

Service Number—Service numbers are telephone numbers assigned to site services such as Auto Attendant, Hunt Groups, Contact Center and more. They are billed in two elements:

-

Service Number—This element is for the bundled service and includes a telephone number and a set number of inbound and outbound minutes per number. This is billed for each day the number is provisioned, similar to how TNs are billed. Refer to the preceding section for billing of phone numbers.

-

Service Number Minutes Overage—Each service number includes 250 minutes per number, per month. Any inbound or outbound minutes over the included amount are billed as overage at a flat rate per minute.

Example: A customer uses 400 minutes on one service number in a billing cycle. 250 of those minutes were included in their Service Number Bundle. The customer will be billed for 150 minutes as Service Number overage.

-

-

Inbound Toll-Free Usage—Cisco Calling Plans supports inbound toll-free numbers in the United States and Canada. This service is billed through three billing elements:

-

Inbound toll-free number Bundle Uncommitted Plan—This element is for the bundled service and includes a toll-free number and a set number of inbound minutes per number. The toll-free number bundle is billed for each day the number is provisioned, similar to how phone numbers are billed. Refer to the preceding section for billing of phone numbers.

-

Inbound Toll-Free Minutes Overage—Each inbound toll-free bundle includes a set number of minutes per number, per month. Any inbound minutes over that included amount are billed as overage at a flat rate per minute.

-

Inbound Toll-Free Activation Fee—Each inbound toll-free number is assessed an activation fee on the first month that it’s provisioned. This is a nonrecurring fee, only billed on the month after the number is activated on your account.

-

-

International Metered Calling—While local and domestic calls are included in your Cisco Calling Plan service, international calls are billed per minute. The International Metered Calling line item shows the total number of minutes billed, along with the average rate per minute.

International per minute rate is based on the destination. Current rates are as follows:

Details on an individual international calls report can be generated from the Control Hub under the Analytics section by running the Detailed Call History report.

-

-

Annexure—Each invoice file contains the primary invoice, in addition to an annexure which contains a breakdown of billable elements within the invoice:

-

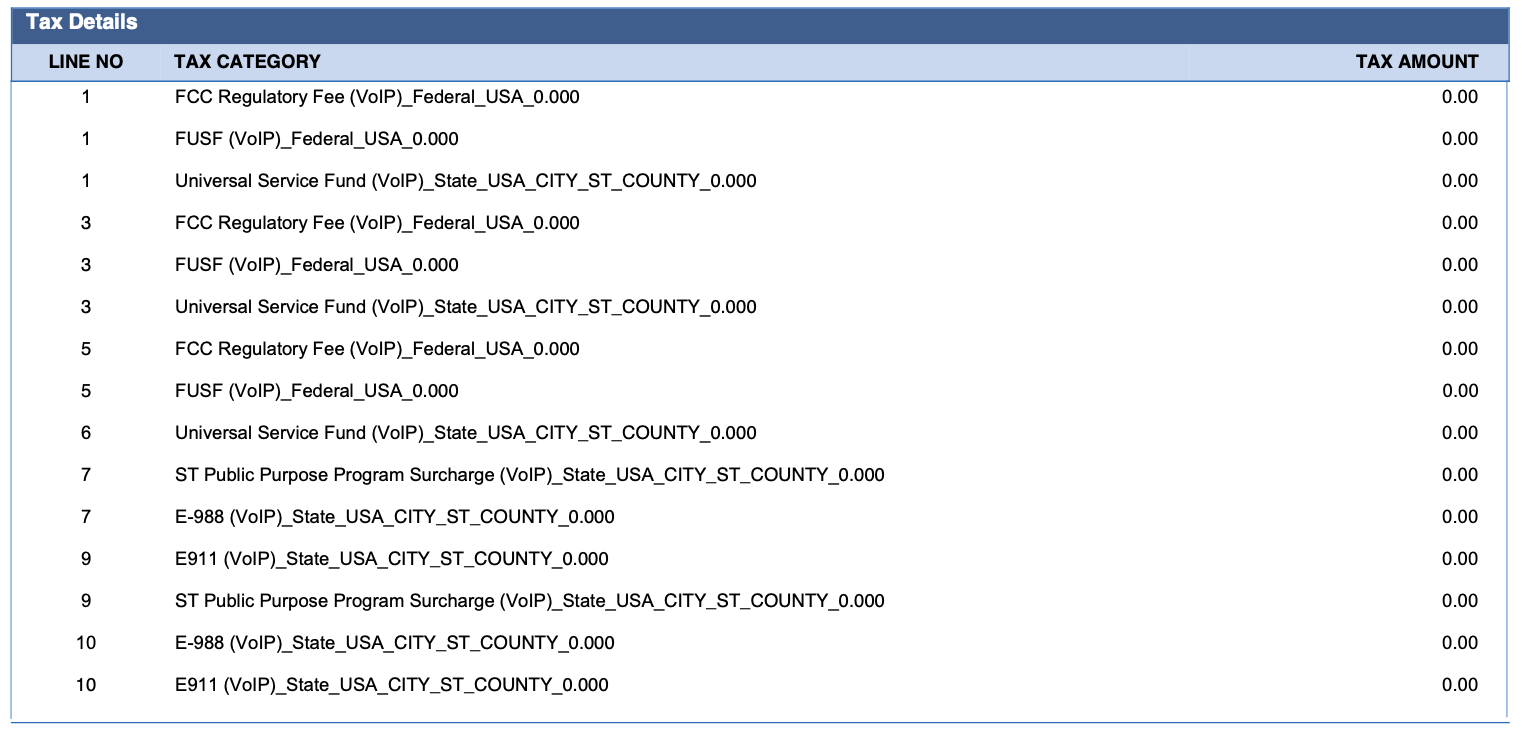

Tax Details—The Tax Details table appears on all the US invoices and contains the various taxes and fees that are assessed with your Cisco Calling Plan service. Due to the regulated nature of telephone numbers, you need to pass along local, state, and federal taxes and fees to consumers of our public switched telephone network service. For invoices outside of the US, VAT or similar taxes are shown in the main section of the invoice.

Some state, country, municipal or other government agencies, public school districts or public institutions of higher learning might be exempt from some regulatory taxes and fees. Contact your Partner if you believe you qualify for tax exemption status for Cisco Calling Plans.

-

Your invoice is based on your Cisco Calling Plan subscription and might include multiple locations depending on how you set up your services. Since taxation is location-based, this section may be lengthy to cover city, county and/or state taxes where your service is deployed. The Line No column is available to help you better understand what invoice line item each tax relates to.

-

-

How are taxes calculated—Taxes that are assessed on regulated services such as Cisco Calling Plan are taxed in multiple ways within the US. While there are many rules and regulations on tax assessment ranging from the city level to the federal level, the following provides some general information on how your services are taxed:

-

Some taxes, such as sales tax or many federal taxes and fees, are based on a percentage of the total cost of those billable items.

-

Taxes associated to phone numbers are based on access lines—which is determined based on the quantity of telephone numbers that are provisioned on the account using industry standard practices.

-

Taxes that are associated to activation fees and other one-time charges are often taxed in the same way the items they are associated to are taxed.

-

Taxes on line items listed as nonlocal might be taxed differently than their ‘local’ counterpart on a bill due to the location of the service being outside of the primary taxable jurisdiction.

-

Taxes and fees on items that are taxed by access line are done so on a monthly basis and are not prorated.

-

-

-

The types of tax that is assessed vary greatly depending on the location of the service. Oftentimes, taxes assessed to phone numbers for items such as emergency services, can be taxed at the state, county, and/or city level. An example of one of the more common taxable elements in the United States is shown below:

-

E911—This tax is a requirement by the state, county, and/or city where the service is deployed which supports the design, construction, operation, maintenance, and administration of public safety communications networks serving the jurisdiction.

The amount that is charged for this type of tax is based on the city, county and/or state regulations where the services are delivered. Cisco only passes along the charges based on those regulations without any mark-up.

-

Tax Category Explanation—Tax descriptions in the Tax Category column shows the following format for non-Federal taxes. Federal taxes omit the City/State/Country information: {TAX}_{TAX LEVEL}_(RATE)_(CITY)_(ST)_(COUNTY).

-

Country level example: E911 (VoIP)_County_USA_0.08_Benton_AR_Saline

-

City Level Example: E911 (VoIP)_City_USA_0.08_Benton_AR_Saline

-

State Level Example: E911 (VoIP)_State_USA_0.08_Benton_AR_Saline

-

Federal level Example: FUSF (VoIP)_Federal_0.29

The (Rate) is the basis for the tax calculation. Depending on the tax type, this rate could be assessed on either the quantity or on the price of taxable services. The (FEDERAL/STATE/COUNTY/CITY) is what jurisdiction the tax is assessed in.

-

-

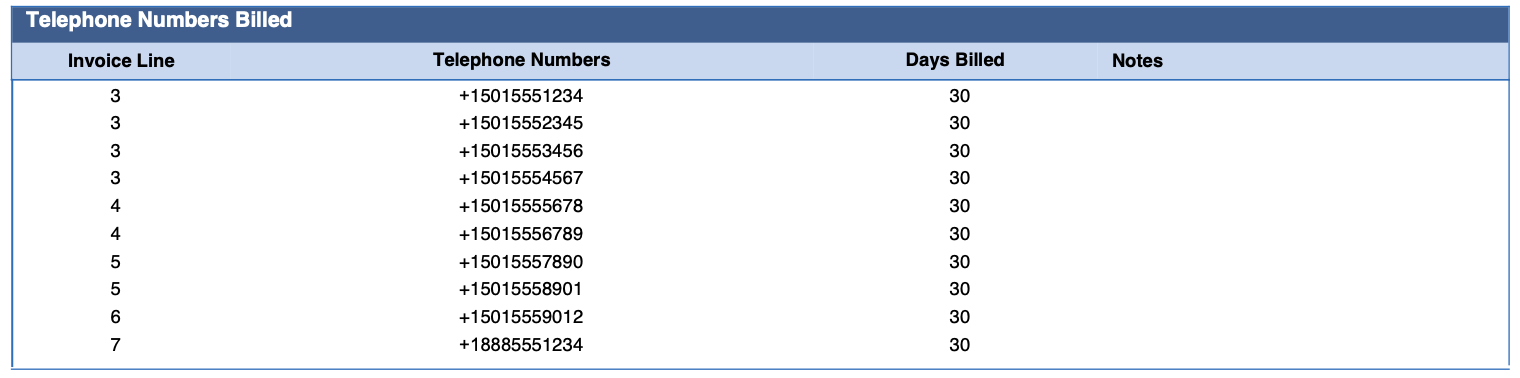

Telephone Numbers Billed—Contains a list of phone numbers which have been charged for during the billing cycle of the attached invoice. This includes which invoice line the phone number was billed against, the phone number, the number of days that phone number was billed for, and any relevant notes if necessary for that particular phone number.

-

For quotes of estimated regulatory taxes and fees, contact our Partner helpdesk at webexcalling-phd@cisco.com.